Oregon’s economy is continuing to recover and change rapidly. We’re 17 months past the initial pandemic recession downturn, and we’ve regained nearly two out of three jobs lost in spring 2020. In the first six months of 2021, Oregon employers added about the same number of jobs as in the 22 months leading up to the pandemic. For reference: when we were 17 months into the Great Recession, we hadn’t recovered at all. The job losses were still mounting. The speed and shape of this economic recovery looks different and has been happening much faster than what we’ve seen in the past.

While many businesses have done a lot of hiring, many others are having a hard time adding as many workers as they'd like right now. Their difficulty is made up of two general parts: competition due to widespread hiring, and a relatively low supply of available workers.

Both Oregon and the U.S. saw a record level of job openings in recent months. In Oregon, private businesses reported 98,000 job vacancies at any given time between April and June. That’s nearly 50% higher than we’ve ever seen in the eight-year history of our job vacancy survey. That spring hiring was happening in all sectors of Oregon's economy, and across more than 240 different types of occupations.

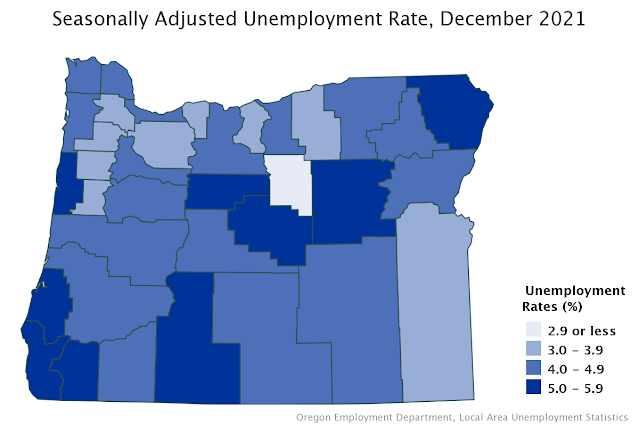

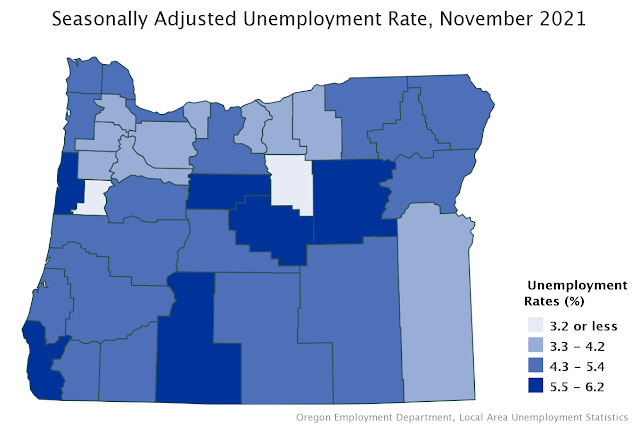

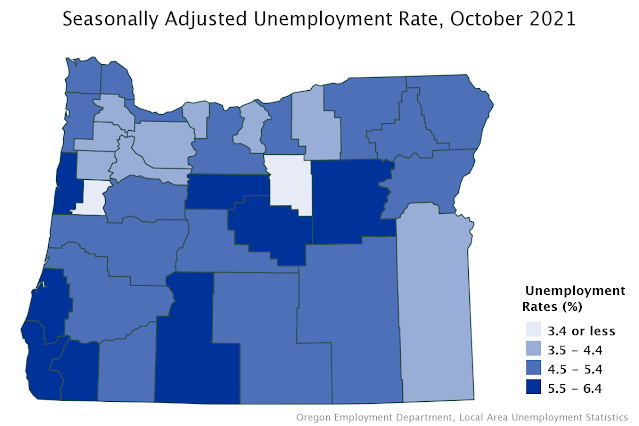

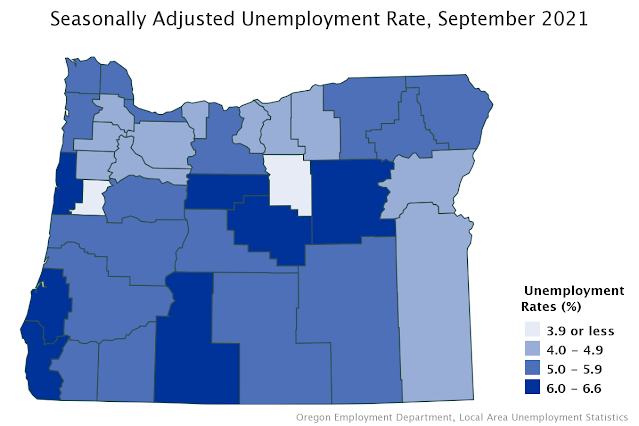

This record hiring demand also comes at a time when there's a

relatively low available workforce. Oregon’s unemployment rate

was 5.6% in June. That’s relatively low by historical standards; the

long-run unemployment rate has been 6.8% in Oregon.

There are also still many people who are having a hard time taking part in this recovery. There were 32,500 Oregonians between April and June who had a COVID-related issue that prevented them from looking for work. That could be their own underlying health conditions, or those parents who are in a bind finding child care or waiting until fully in-person school returns. While this trend has improved, in recent days the COVID-19 Delta variant has been on the rise.

Taken together, the strong hiring, relatively low unemployment, and barriers keeping some workers on the sidelines are creating a tight labor market. Employers have responded to tight labor market conditions in a number of ways.

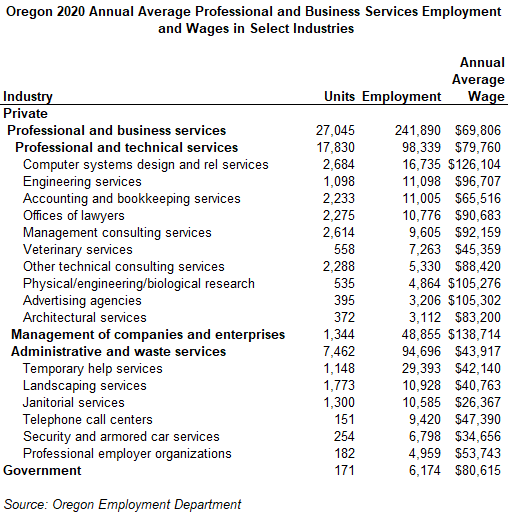

WagesFor one, employers have raised wages. Real (or inflation-adjusted) average starting wages rose by more than 2% in Oregon over the past year. Businesses have raised their wages for existing workers too. Real average hourly earnings for all workers also rose by more than 2% compared to the pre-recession level.

Benefits and PerksNot every employer can raise wages. Some have found other ways to recruit and retain talent. The labor market was also tight prior to the pandemic. In 2018 we surveyed private employers to ask about the

benefits they offered employees. Three out of five offered health benefits, and half offered retirement benefits. One out of 10 of employers offering health insurance, and one out of five offering retirement benefits, cited worker hiring and retention advantages related to those offerings.

Half of Oregon's private firms offered paid holidays, and half offered paid vacation days. One-third offered at least one of the following: flexible work schedules, production or performance bonuses, paid professional development training, and life insurance.

Relaxing Experience RequirementsWhen the labor market has been tight in recent years, some employers have loosened their previous work experience requirements. This spring, about half (53%) of all job vacancies required previous work experience. Nearly 19,000 of the 98,000 job vacancies this spring required less than one year of prior experience. The largest number of these job openings requiring less than one year of experience were for restaurant servers, retail sales staff, nursing assistants, restaurant cooks, and food prep workers. When it doesn’t pose a safety risk, and employers are able to, loosening previous experience requirements can increase the number of people who qualify for their job openings.

Recruitment IntensityIn tight labor markets, employers tend to layer help wanted signs with other efforts such as referral incentives, signing bonuses, posting with online job boards, and working with recruiters outside of their immediate geographical area. This includes listing job openings with WorkSource Oregon, where tens of thousands of workers have been registering in the job matching system.

Any layering employers can do with their hiring and retention strategies

can help them find and keep more workers in a tight labor market.