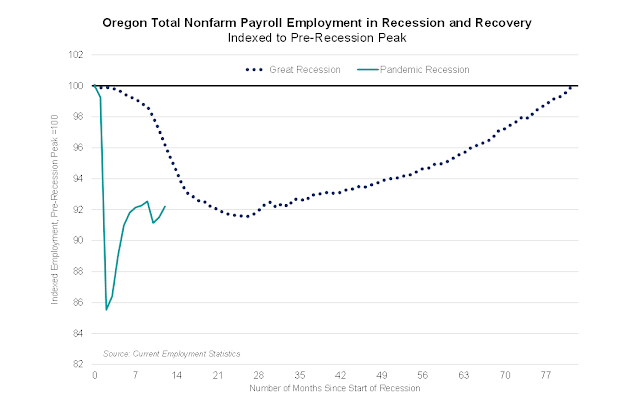

The pandemic recession had a faster onset with deeper impacts than even the Great Recession. The record-breaking layoffs that occurred in the spring of 2020 in response to the COVID-19 pandemic also occurred at breathtaking speed. Oregon lost 285,500 nonfarm payroll jobs from February to April, a decline of 14.5%. By comparison, at the steepest point of decline in the Great Recession, 27 months into the downturn, employment had dropped 8.5% from its peak.

One distinction of the pandemic recession was that overwhelmingly, those who became unemployed due to job loss were on temporary layoff. At peak unemployment in April 2020, those who lost jobs accounted for 84% of unemployed Oregonians. Among them, 86% were classified as on temporary layoff. That’s quite a reversal from the Great Recession; during its months of highest unemployment, nearly three-fourths (72%) of layoffs were due to permanent job losses.

In addition to those who lost jobs – temporarily or permanently – many more Oregonians found themselves working less than they would have liked in 2020. Oregon’s broadest (“U-6”) measure of labor underutilization hit a series high of 20.9% in April 2020. That means one out of five workers or would-be workers were either out of work, discouraged from looking due to lack of prospects, sought work in the past year but not the past four weeks, or were working fewer hours than they’d like to be scheduled.

Most of those in this expanded measure of labor underutilization were involuntary part-time workers. Between February and May 2020, the number of Oregonians working part-time for economic reasons doubled to 159,700.

Another distinction of the pandemic recession was that, through either

federal loans or altered business practices, many Oregon employers were

able to keep operating either with fewer workers, or with workers on

reduced schedules. Throughout 2020, the number of business

establishments overall grew each quarter. Even in leisure and

hospitality, the hardest-hit sector that lost half its jobs in spring

2020, the total number of payroll business units remained stable

throughout the year.

Phased re-opening began in Oregon in May,

and with it, record-breaking monthly job gains came. Oregon had its

largest-ever monthly employment gain in June 2020, adding 52,300 jobs.

That momentum was not sustained though; monthly job gains tapered over

the summer and into fall Oregon continued to register smaller monthly

gains heading into the fall.

As COVID-19 cases also began to rise

in the fall, Oregon instituted an initial “two week freeze” that

included additional health and safety measures. Subsequent limitations

on economic activity to prevent community spread of the disease by

county and COVID-19 risk category continued through the rest of 2020 and

into 2021.

In December 2020, Oregon lost 27,500 jobs over the

month. Absent the pandemic, that December loss would have represented

the biggest monthly job decline in Oregon since at least 1990.

In the wake of lower COVID-19 case counts and accelerated vaccine rollout, more areas of the state have moved out of extreme COVID risk categories, and job gains have

resumed. Total nonfarm payrolls in Oregon added a combined 20,900 jobs

in January and February 2021. The latest forecast

from the Office of Economic Analysis predicts stronger growth in 2021

and 2022 than Oregon has seen in decades, and a return to pre-pandemic

employment in early 2023.

Many more details are available in the full year in review article.

No comments:

Post a Comment